Your completed Sworn Statement for the transfer of a used vehicle in Ontario (Form 1155E) will need to be commissioned in order to be accepted at ServiceOntario. Neighbourhood Notary can help you commission it.

|

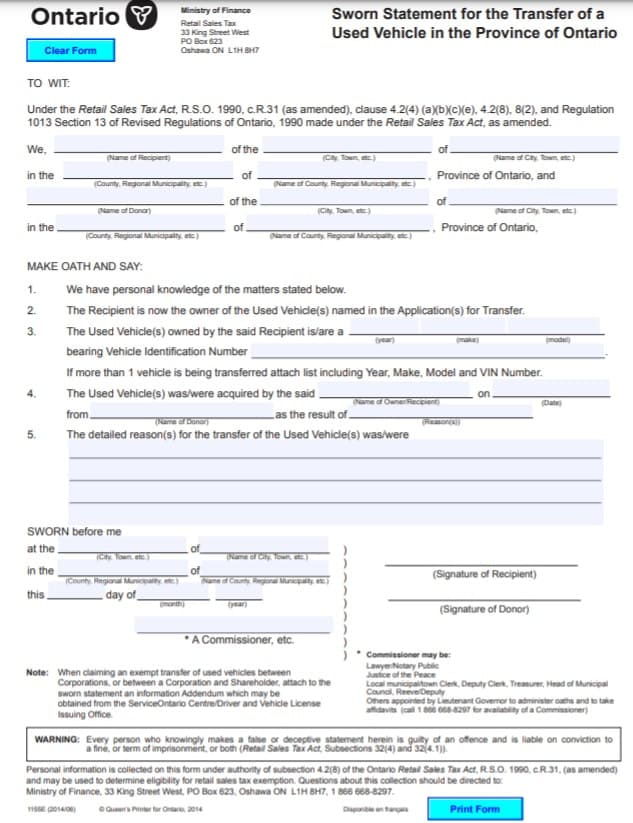

What is it?

In Ontario, when selling a vehicle privately, retail sales tax is payable when the vehicle ownership is transferred. Learn more here about how retail sales tax applies to different vehicles. However, there are instances where a retail sales tax exemption may be applicable. One instance is between certain family members (previously discussed here). Other instances where you may claim a retail sales tax include, but are not limited to:

Sworn Statement to Transfer In some of the above instances where your vehicle transfer is exempt from retail sales tax, ServiceOntario may require a Form 1155E to be filled out (download here). Form 1155E requires the following information: the transferor's name and city/municipality of residence, the transferee's name and city/municipality of residence, the year/make/model of the vehicle, the vehicle's VIN number, the date the vehicle is to be transferred, and the reasons for the transfer. After your Form 1155E has been filled out, Neighbourhood Notary can help you commission it. |

DISCLAIMER: information provided in this article is for informational purposes only. It may not be up-to-date and may not be accurate. It shall not be construed as legal advice. Please contact the relevant governmental entity or organization for the most up-to-date and accurate information.

|

|

Need help commissioning your Sworn Statement for the Transfer of a Used Vehicle in Ontario?

|

In-Person Appointment

|

Online Appointment*

*This document may be eligible to be notarized online.

|